what food items are taxable in massachusetts

In the state of Massachusetts any service charge by a caterer is not considered to be taxable so long as the caterer prepares food which was owned by the client at a fixed location on an. Generally food products people commonly think of as groceries are exempt from the sales tax except if they are sold as a meal from a restaurant part of a store.

How Do State And Local Sales Taxes Work Tax Policy Center

Snack bars including theatre snack bars.

. Massachusetts has one sales tax holidays during which certain items can be purchased sales-tax free. Clothing costing under 175 per item is fully exempt from the state sales tax rate with items over 175 only being taxes on the amount exceeding the 175 exclusion. While it may not be on most restaurant menus anymore grapenut custard is a classic Massachusetts dessert that harkens back to a simpler time.

Groceries are generally defined as unprepared food while pre-prepared food may be subject to the restaurant food tax rate. Prescription medicine groceries gasoline and clothing are all tax-exempt. Grocery items are taxable but taxed at a reduced rate of 175.

What foods get taxed. A vending machine which sells food such as candy snacks or sandwiches is generally not considered a restaurant and the sales are not taxable providing that the vending machine. Most items that cost less than 175 are exempt from sales tax including everyday shoes and even shoelaces.

When foods are categorized as necessities based on nutritional value soda and candy are among the first products to be added to the taxable list. Items above 175 are taxable atthe statewide Massachusetts rate of 625. Ice cream or other food product stands.

Street wagons or carts. Food products for human consumption and food items purchased with federal food stamps are generally exempt from the sales tax. The Massachusetts sales tax is.

Liquor used to be subject. Sales of food and beverages for consumption at your place of business are usually. Items above 175 are taxable at the statewide Massachusetts rate of 625.

What purchases are exempt from the Massachusetts sales tax. What items are not. Are meals taxable in.

Some services in Massachusetts are subject to sales tax. Grocery items are generally tax exempt in Massachusetts. In the state of Massachusetts sales tax is legally required to be collected from all tangible physical products being sold to a consumer.

The following operations whether they stand alone or are. Heated foods salads and sandwiches and cheese and finger-food. Food must meet these conditions to be exempt from tax.

What items are not taxed in Massachusetts. In Massachusetts all clothing and footwear items at 175 or less are exempt from sales tax. Private or social clubs.

Several examples of exceptions to this tax are. This includes soft drinks candy and other food types that many other states consider taxable. Candy and soda may be included or excluded from any.

Below are some of the more interesting ones weve found. In Massachusetts all clothing and footwear items at 175 or less are exempt from sales tax. The exemption for food includes.

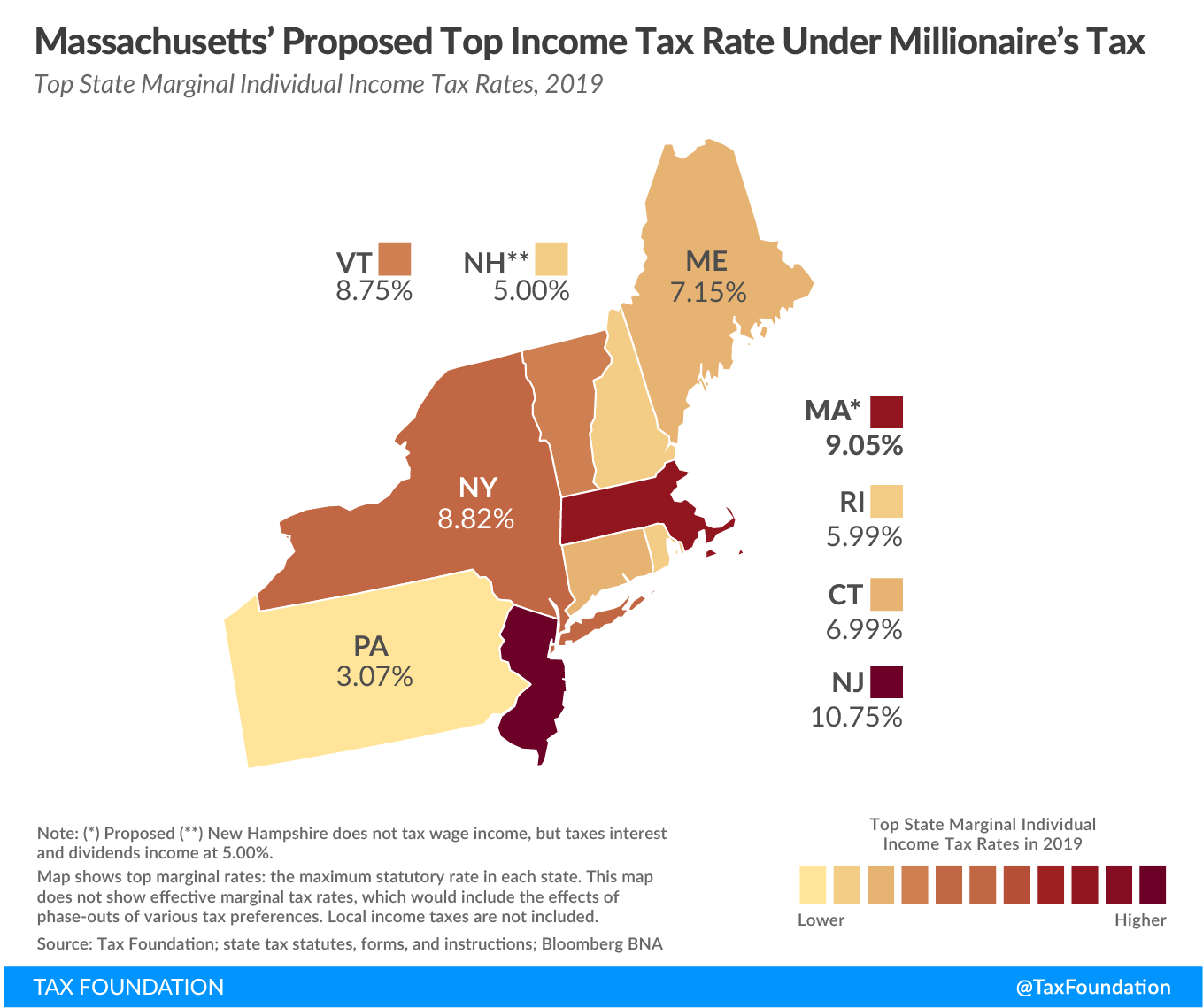

Massachusetts Legislature Moves Forward Millionaires Tax

Massachusetts Income Tax Calculator Smartasset

D M Pizza Menu In Attleboro Massachusetts Usa

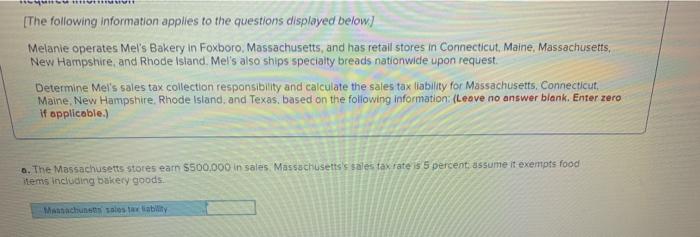

Solved The Following Information Applies To The Questions Chegg Com

Kings Pizza And Grill Menu In Mattapan Massachusetts Usa

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Sales Tax On Grocery Items Taxjar

Massachusetts Income Tax H R Block

Washington Sales Tax For Restaurants Sales Tax Helper

Massachusetts Sales Tax Small Business Guide Truic

These Are The Unhealthiest Grocery Items You Can Buy In The United States According To Moneywise Masslive Com

Exemptions From The Massachusetts Sales Tax

Is Food Taxable In Massachusetts Taxjar

When Is Tax Free Weekend In Massachusetts Nbc Boston

Istanbul Diner Cafe Menu In Revere Massachusetts Usa

Cisa Community Involved In Sustaining Agriculture Collecting Sales Tax On Farm Products

In A Surprise Baker Says Taxpayers Could Receive North Of 2 5 Billion In Tax Relief Under Little Known Law The Boston Globe

How Are Groceries Candy And Soda Taxed In Your State

Tax Free Weekend 2022 Can You Shop Online During Massachusetts Holiday Masslive Com